Illinois’s State Budget Impasse

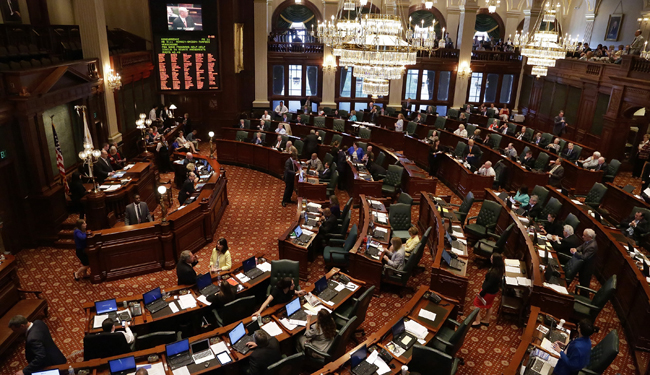

Passing the annual budget is often a difficult task for state governments, particularly during lean fiscal periods. Over the past few months, Illinois has found resourceful ways to avoid a complete government shutdown after not passing their annual state budget.

The state is making its way through the second month of the fiscal year without a budget. Previously created laws and court decisions require funding to continue for about 80% of state spending, including paying state employees and Medicaid bills. However, many of Illinois’s economic incentive programs have been suspended as the state deals with no full year plan for spending.

Governor Rauner wanted a substantially reduced budget compared to what was passed by the General Assembly in June. The General Assembly’s proposed budget had revenue increases to fix the state’s current deficit, which Governor Rauner was open to if changes were made to workers’ compensation, civil lawsuit damage award limits, and public union bargaining and contracting rules, as well as a freeze on property taxes. Two months later, neither side seems much closer to an agreement. A small sign of progress occurred August 12 when the State House agreed unanimously to free $5.2 billion in federal funding that had been unavailable since July 1st because no budget has been passed.

While the federal funding will help, 20 percent of recently surveyed state social service providers will run out of money in the next few weeks. Along with economic development programs, state universities are also part of the list of organizations not getting funding. ReBoot Illinois has created a continually updating map of people and organizations that have been impacted by the budget impasse.

Newly-elected Governor Bruce Rauner has wrestled with how best to handle state business incentive programs. In April, the Rauner administration lifted the spending freeze it placed upon $100 million in business tax incentives for the state’s Economic Development for a Growing Economy (EDGE) program. The EDGE program provides tax credits to corporations to encourage the businesses to expand their operations in Illinois. To help reduce the state’s current deficit of $4 billion, at the start of June Governor Rauner suspended the application process for any future economic incentives used to attract and grow businesses. These programs have yet to be reactivated.

Illinois’s unusual situation is risky for the state’s economic future if funding for key state economic growth programs continues to stay low. The state’s credit rating will likely be downgraded soon and Illinois was recently ranked last in financial health by the Mercatus Center at George Mason University. Although no end appears to be in sight, Illinois will eventually have to pass a budget or else face running out of money completely. Until then, the future of Illinois’s business incentive and other economic development programs remains uncertain.